What is the FINANCIAL MARKET?

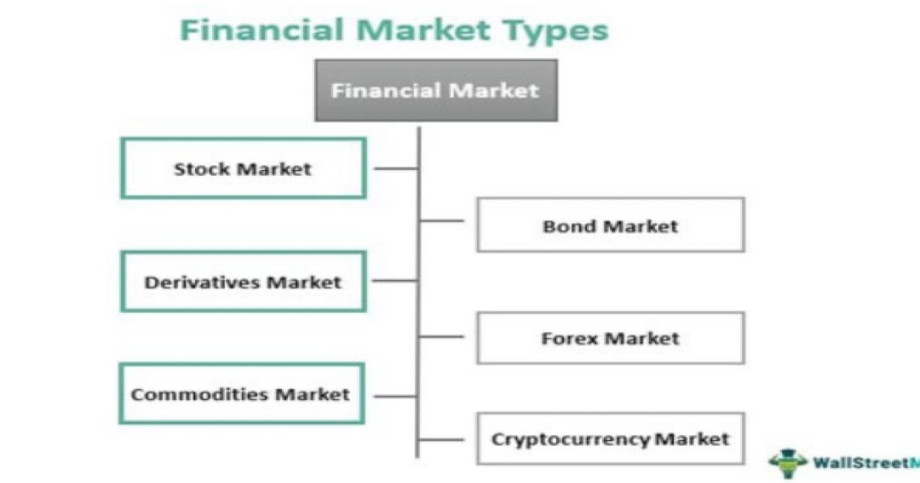

A financial market is a market in which people trade financial securities and derivatives at low transaction costs. Some of the securities include stocks and bonds, raw materials and precious metals, which are known in the financial markets as commodities. The term "market" is sometimes used for what are more strictly exchanges, organizations that facilitate the trade in financial securities, e.g., a stock exchange or commodity exchange. This may be a physical location (such as the New York Stock Exchange (NYSE), London Stock Exchange (LSE), JSE Limited (JSE), Bombay Stock Exchange (BSE)) or an electronic system such as NASDAQ. Much trading of stocks takes place on an exchange; still, corporate actions (merger, spinoff) are outside an exchange, while any two companies or people, for whatever reason, may agree to sell the stock from the one to the other without using an exchange. Trading of currencies and bonds is largely on a bilateral basis, although some bonds trade on a stock exchange, and people are building electronic systems for these as well, to stock exchanges. There are also global initiatives such as the United Nations Sustainable Development Goal 10 which has a target to improve regulation and monitoring of global financial markets. Within the financial sector, the term "financial markets" is often used to refer just to the markets that are used to raise finances. For long term finance, they are usually called the capital markets; for short term finance, they are usually called money markets. The money market deals in short-term loans, generally for a period of a year or less. Another common use of the term is as a catchall for all the markets in the financial sector, as per examples in the breakdown below. Capital markets which consist of: Stock markets, which provide financing through the issuance of shares or common stock, and enable the subsequent trading thereof. Bond markets, which provide financing through the issuance of bonds, and enable the subsequent trading thereof. Commodity markets, The commodity market is a market that trades in the primary economic sector rather than manufactured products, Soft commodities is a term generally referred as to commodities that are grown, rather than mined such as crops (corn, wheat, soybean, fruit and vegetable), livestock, cocoa, coffee and sugar and Hard commodities is a term generally referred as to commodities that are mined such as gold, gemstones and other metals and generally drilled such as oil and gas. Money markets, which provide short term debt financing and investment. Derivatives markets, which provide instruments for the management of financial risk.[2] Futures markets, which provide standardized forward contracts for trading products at some future date; see also forward market. Foreign exchange markets, which facilitate the trading of foreign exchange. Cryptocurrency market which facilitate the trading of digital assets and financial technologies. Spot market Interbank lending market The capital markets may also be divided into primary markets and secondary markets. Newly formed (issued) securities are bought or sold in primary markets, such as during initial public offerings. Secondary markets allow investors to buy and sell existing securities. The transactions in primary markets exist between issuers and investors, while secondary market transactions exist among investors. Liquidity is a crucial aspect of securities that are traded in secondary markets. Liquidity refers to the ease with which a security can be sold without a loss of value. Securities with an active secondary market mean that there are many buyers and sellers at a given point in time. Investors benefit from liquid securities because they can sell their assets whenever they want; an illiquid security may force the seller to get rid of their asset at a large discount.